international marketing assignment

Why is acquisition often the preferred way to establish wholly-owned operations abroad and what are it's limitations as an entry method?

international marketing assignment

Why is acquisition often the preferred way to establish wholly-owned operations abroad and what are it's limitations as an entry method?

acknowledgements

I would like to thank Mr. VIJAY CHINTAMANENI, my course leader for International Marketing for his continuing interest, encouragement, and support in helping me complete this assignment.

We are all influenced by the thoughts and ideas of other people which tend to drift into the subconscious and are not always distinguished clearly from one’s own. I have attempted to give references for sources of work by other writers but apologise to any concerned if acknowledgement has inadvertently not been recorded.

CONTENTS

1. Acknowledgements

2. List of Figures

3. Abstract

4. Introduction

5. Market Entry Strategies

6. Acquisitions

7. Advantages of Acquisitions

8. Disadvantages/ Limitations of Acquisitions

9. Continued Growth of Acquisitions

10. In Search of the Optimum Acquisition

11. Conclusion

12. Bibliography

13. Appendix

LIST OF FIGURES

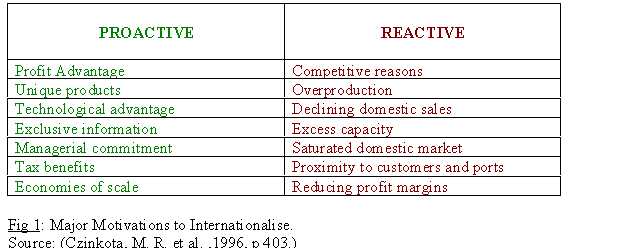

1. Major Motivations to Internationalise

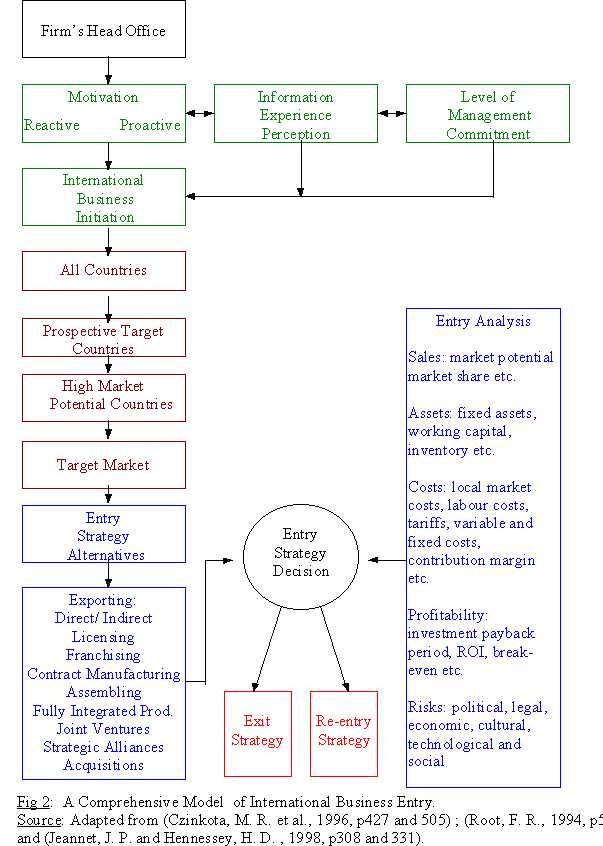

2. A Comprehensive Model of International Business Entry

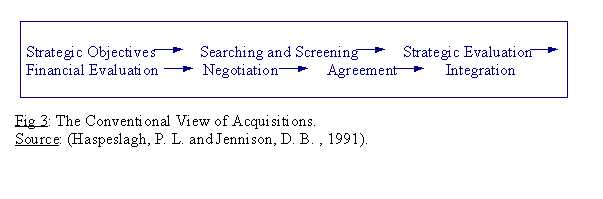

3. The Conventional View of Acquisitions

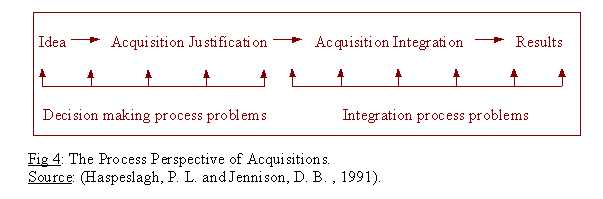

4. The Process Perspective of Acquisitions

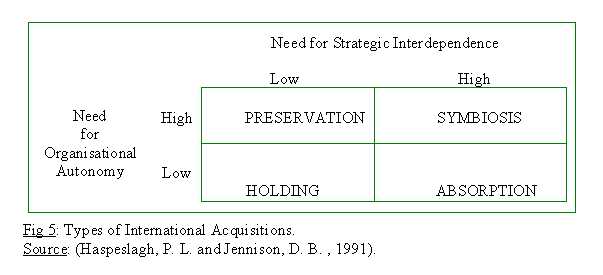

5. Types of International Acquisitions

abstract

Changes in the world environment are bringing new threats and opportunities to individuals and firms. The challenge lies in competing successfully in the global marketplace as it exists today and develops tomorrow. We are moving from a market in which each national market is a distinct, isolated entity towards a system in which the whole world is one huge marketplace. Though international business holds out the promise for continued corporate growth, firms cannot simply jump into the international arena and expect to be successful. A range of issues has to be considered constantly to have a fair chance of survival. One such issue that needs to be considered at the very beginning is the mode of international market entry. Though no single, universal best strategy exists Acquisition provide a good and rapid alternative. Through an acquisition a company buys-out the assets, stocks or securities of another company, thereby gaining operational control of the acquired firm. The heightened acquisition activity in the past few decades has been for a number of reasons. However acquisitions also suffer from a series of limitations which often leads to it’s failure. Organisations should therefore take various precautionary steps to ensure the success of the acquisition and the smooth integration of the acquired firm. Despite these problems exist acquisitions continue to grow and will probably continue to be an important business activity, for corporate growth, throughout the next millennium.

Introduction

Individuals and nation states have involved themselves in international trade ever since the first national borders were formed. The wave of internationalisation of the economic activities was much enhanced by the onset and diffusion of industrialisation, in Europe, from the 18th century onwards. Today economic activity is not only more internationalised but it is increasingly becoming globalised. “Globalisation is a complex and advanced form of internationalisation which implies a degree of functional integration between internationally dispersed economic activities.” (Dickens, P., 1992, p1.). To survive gallantly in this ‘global village’ firms need to co-ordinate their marketing activities within the social, cultural, political, economic, technological, and legal constraints of the global environment. A key concern of international marketing strategist, therefore, is to decide the market entry strategies that it must adopt to meet the ‘global customer’ needs better than the competitors.

Market Entry Strategies

Successful market entry strategy is built on the pre-requisite of a systematic ‘environmental scanning’ of both the macro and the micro variables involved in a foreign market opportunity. {See figure on next page). A market entry is not an end in itself but is a means to an end. A variety of motivations can push and pull firms along the international path. An overview of the major motivations that have been found to make firms go international is provided in the table below:

Before selecting a market entry mode organisations have to consider a range of criteria. See figure below:

· The company goals in terms of volumes of international business, geographical coverage, international market share, profitability etc.

· Costs: Organisations have to consider indirect costs such as freight charges, costs of strikes, disruptions to output, as well as “the costs of doing nothing which may be higher than the attendant risk of moving into a relatively unknown market.” (Paliwoda, S. J. and Thomas, M. J. , 1998, p125).

· The level of flexibility required.

· The variety of risks associated with the entry mode.

· The investment payback period.

· The speed of market entry desired.

· The managerial commitment.

· The organisation’s product line and the nature of the products.

· The intensity of competition abroad.

Based on the results of the above parameters, organisations have to make their entry strategy choice which may include exporting, licensing, franchising, contract manufacturing, assembling, local production, joint ventures, strategic alliances or through acquisitions. {See appendix 1 for examples on each of the above methods.}

Acquisitions

The most celebrated and often preferred strategy for establishing wholly-owned operations abroad are the ‘inorganic growth’ strategies of mergers and acquisitions. A merger is where two companies agree to come together as one company-maybe with a new name, whereas an acquisition means that one company buys out the other company. “An acquisition may be defined as a transaction in which a buyer acquires all or part of the assets, business, stock, or other securities of the selling company, there by gaining operational control of a part or all of the acquired firm.” (Salter, M. and Weinhold, 1979, cited by Thakur, M. et. al., 1997, p103 ). A company may acquire another company through a tender offer to its shareholders or may even make a hostile take-over.

The conventional view of acquisitions regards the take-over process as compartmentalised and believes that the value of an acquisition can be understood and predicted accurately at the time of the agreement.

On the other hand the alternative prospective stresses that the success of an acquisition is determined by the competitive advantage that is achieved as a result of the post-acquisition management.

Based on the need for strategic interdependence and organisational autonomy acquisitions may be classified as shown in the diagram below:

Another classification of international acquisitions can also be done on the basis of the synergy in the industry of the acquirer and that of the acquiree.

1. Domain Strengthening: This type of acquisition takes place when a rival firm producing similar or overlapping products, but serving in a different market is acquired.

2. Domain Extension: When a firm applies its core competency to a new or related business by acquiring a firm already present in that business, such an acquisition takes place.

3. Domain Exploration: When a firm moves into a new business area, demanding completely different core competencies , by acquiring a firm already present in the new business such an acquisition takes place. However research studies have found that “total gains from related acquisitions were significantly higher than in unrelated acquisitions, implying that the synergies available from related acquisitions were higher than those available from unrelated acquisitions” (Singh, H. and Montgomery, C., 1987).

Advantages of Acquisition

The purpose of an acquisition is to add value - both economic and non-economic that relates to the benefit of the stakeholders at large. The acquisition route was initially favoured for a period in the 1960s when managing was regarded as a universal skill and portable from industry to industry. During this wave of the take-over activity, firms producing a narrow product range pursued an acquisition strategy aimed at achieving business diversification and a wider geographical consolidation. Today acquisitions as a market entry method allows even newly formed companies to directly reach the global category and not necessarily follow the traditional stages of development. “International acquisitions provide a unique approach to transform firms and to contribute to corporate renewal.” (Haspeslagh, P. C. and Jennison, D. B.,1998) or example, by acquiring Rowntree , Nestle immediately achieved a leading position in the European confectionery industry, something which it had failed to do through decades of internal development.

When a manufacturer wants to rapidly diversify into new markets, acquire expertise (technical, marketing or managerial) and yet retain maximum control acquisition provides the best solution, provided attention is paid to the post acquisition integration. For example, “To enter the Thai market, Heinz acquired a 51% interest in Win-Chance Foods Co. Ltd., and renamed it Heinz Win Chance Ltd. The three partners who began the business continued the operation owing to their understanding of the market and their familiarity with Thailand’s laws and government.” (Anthoony, J.F., 1988, p65 cited in Onkvisit, S. and Shaw, J. J., 1993, p183).

Acquisitions effectively purchases instant market information, market share and the channels of distribution. This helps the acquiring company to maintain the established success of the acquired company and simultaneously build it up. The rapid increase in foreign take-overs by Japanese firms was due to the increased purchasing power of the stronger yen, and the ease of market entry provided by take-overs as opposed to the 2-3 years it takes to develop a market from scratch. Along with the acquisition of the organisation’s assets and liabilities the acquirer also gains a local workforce, national management and established contacts with the government.

Acquisition of a competitor abroad serves the dual purpose of reduced competitive pressure and opportunity for increased profitability.

Acquisitions can also help lower logistics costs through increased economies of scale. Moreover the infusion of ‘new blood’ into the organisation may help achieve increased sales of the acquiring firm.

Acquisitions also serves as an important re-entry method. For example, Electrolux, a billion dollar communication and industrial goods firm re-entered the US market by acquiring National Union Electric (NUE), a maker of vacuum cleaners and air-conditioners. Electrolux’s rationale was as follows:

· “Immediate access to the US market for various Electrolux products through NUE’s network of 37,000 independent dealers.

· NUE’s product line could be carried throughout the world via Electrolux’s worldwide marketing organisation. “ (Terpstra, V. and Sarathy, R., 1991, p391).

Disadvantages / Limitations of Acquisitions

Though the potential benefits from international acquisitions appear overwhelming, in reality organisation also have to face certain disadvantages and obstacles, which in some cases even lead to a subsequent deterioration in the acquirer’s performance.

Acquisitions are viewed in a different light from other kinds of foreign investment since it displaces and replaces domestic ownership and therefore host country governments adopt a less ‘open door’ approach to foreign acquisitions. For example “ there was a heated debate before the UK allowed Sikorsky, a US firm to acquire Westland, a failing British manufacturer of military helicopters.” ( Zikmund, W.G. et al., 1995, p368).

Due to the sensitive nature of acquisitions, some countries impose various legal hurdles. For example , “in Germany the Federal Cartel Office may prohibit or require divestiture of those acquisitions that could strengthen market domination.” (Zikmund, W. G. et al., 1995, p 368). Several OECD countries also have anti-trust or acquisition policies to ensure that no negative implications of acquisition arise on competition.

In many countries acquisition is very likely to be perceived as an exploitation or a blow to national pride. In most Continental European Countries, Japan take-over bids are invariably doomed to fail because of various cultural factors rather than legal or political factors. “In Japan, being acquired is perceived like having to sell one’s family.” (Marwick, P, 1983, p5).

Acquisitions are also vulnerable to changes in the currency exchange rates. A buyer whose home country is getting weaker will see the cost of the acquisition go up.

“According to a study by Business Week and Mercer Managemnent Consulting Inc. of 150 deals worth at least $ 500 million, acquisitions do not benefit shareholders. When judged by stock performance in relation to Standard and Poor’s industry indexes, about half of the 150 deals harmed shareholder wealth, while another one-third hardly contributed anything.” (Business Week, 1995, p178).

One of the most important things that is easy to lose sight of, during an acquisition is its impact on the employees. An acquisition creates uncertainties in the minds of the employees and due to communication and language barriers the transitioning of employees becomes difficult. The problem becomes further complicated when there is a general clash of interest between the workforce and the new management that ultimately leads to strikes. For example “Japan’s Bridgestone Corporation paid $ 2.6 billion to acquire money-losing Firestone Tyre and Rubber Company and lost $1 billion in the first five years after the acquisition while enduring a bitter and lengthy strike.” (Business Week, 1995, p178).

Another important issue that can seriously affect the success of an acquisition is the difference in the corporate cultures of the acquirer and the acquiree. The core of an organisation’s culture is encapsulated in the paradigm of the organisation, which consists of three layers- values, beliefs and assumptions. The circumstances leading to an acquisition may cause a strategic drift in the firm being acquired and subject its culture to critique. However if the culture is highly cohesive, any change in the corporate culture is likely to cause tension and conflict. The problem becomes further complicated when the acquiring firm looks for a change in the culture, per se without realising that a culture is built over a number of years and is prevalent in the organisation’s stories, symbols, rituals, routines, control systems, and power structures.

Apart from being complex, expensive and risky international acquisitions also bring along with it various other problems such as finding the right company, determining a fair price, geographical distances, language barriers, stakeholder opposition and even rival bidding .

Continued Growth of Acquisitions

Inspite of the various limitations mentioned above there does not appear to be any sign that acquisitions are abating The value of announced transactions in January and February 1999 was around the same level of December 1998 and over 200% up on the same period of 1998. In terms of the number of deals the US bought 1,173 foreign firms while selling 608 firms to foreigners. The other leaders in the game include the UK, Germany, France and Japan. The reasons for the heightened acquisition activity include the following:

Consolidation: Consolidation requires companies to divest those divisions that are not related to the core of the business. At the same time companies begin a round of acquisitions, to acquire those businesses that complement the core of the present firm. This admonition to ‘stick to the knitting’ has become the watchword for the conglomerates. “Consolidations are the name of the game in the health-care industry. Hospitals are winning clout by purchasing alliances, while drug producers are consolidating to search for new products and wider distribution” (Weber, J., 1994, p30).

Institutionalisation: The huge premiums paid for the buy-outs of companies enhanced the popularity of acquisitions. Overall foreign acquirers pay almost twice as much as much as domestic buyers would. “Contrary to theology, it is the well-run companies which attract take-overs.” (Chakravaraty, M., 1997). Moreover with voluminous funds at their disposal overseas investment bankers provide capital more directly to the acquisition market through debt financing, issue of securities or equity participation.

The poor economic outlook in most parts of the world and the rising interest rates also point to a continued acquisition activity.

Increasing liberalisation of many countries has also raised the chances of prospective privatisation of a wide range of state run activities.

Increased acquisition activity is also seen among buyers who look for deal making opportunities and seek financial gains through purchase and resale of the company..

“Continuing interest in acquisition is also taking place in western Europe where economies are stable and barriers to hostile bids seem to be eroding” (Taggart, J.H. and McDermott, M.C., 1993, p512).

In Search of the Optimum Acquisition

Acquisitions suffer from a high incidence of failure, which is even higher in case of cross border deals due to additional problems. Inorder to ensure that the acquisition process takes place smoothly the following recommendations should be considered:

+ The acquiring firm should encourage a pro-active approach towards international market entry.

+ A special task force should be set up to screen the options and identify attractive targets. A series of tests should be undertaken to find out the ‘real’ value of the acquisition. These tests include:

· The attractiveness test:- present as well as potential attractiveness of the industry.

· The total cost-of-entry test:- total price paid including other hidden and opportunity costs.

· The better-off test:- the resultant increase in the competitive advantage.

+ The acquirer and the acquiree must share a common core of unity. It is important to look past the hard, material assets and consider the other party’s real strengths and weaknesses.

+ An acquisition should not be viewed merely as an opportunistic move. The acquiring company must draw a series of action plans targeting the industry and/ or the company to be acquired. Moreover the acquisition must fit in with the strategic momentum of the organisation.

+ An important aspect that should not be overlooked is the issue of the right timing and a fair price for the acquisition. The acquiring firm should avoid paying a lop-sided premium that might distort it’s capital structure, liquidity or leverage position.

+ Provision for cross-company training at various levels of management should also be made. Similarly, appropriate changes in the personnel between the two units can also help the acquisition process. Decisions regarding various functional areas should be made through effective administrative and organisational interaction

+ The existing management team and its practices should be treated with an ‘accepting and understanding’ viewpoint that marks respect and consideration.

+ The uncertainty and anxiety in the minds of the employees should be addressed through open communications, real assurances and active participation. The aim should be to develop commitment and willingness of the employees and prevent a loss of identity or hostility towards the new management.

+ Through an institutional leadership, clear vision and purpose the acquiring firm should try to bring changes in the symbolic activities, which in turn can gradually help in bringing cultural change. Moreover efforts should be made for a reciprocal understanding of the organisational culture by both sides.

+ Finally, continuous screening of the various factors in the new dynamic environment should be carried out to avoid local protests and ensure a smooth integration.

Conclusion

To survive in the global battles for market dominance, companies have to become increasingly creative in their entry strategy choices. Acquisition is just one way to gain access to the international arena and it too is not ‘problem-free’. “Indeed, a 1988 study by McKinsey and Co. found that most organisations would have profited more by simply keeping their money in the bank instead of acquiring another company.” (Lyles, M, 1991). This clearly points to a more calculative and focused analysis to identify the necessary synergy needed to sustain and expand the firm’s competitive advantage. Selection of a market entry mode has an important bearing on the firm’s strategy, and can later prove to be a severe constraint on intended global expansion unless due care and attention is exercised. The future holds various challenges that will put to test the skills of international managers anew. It is important here to critically assess new and developing forms of market entry ‘mixes’, rather than view them as limited, compartmentalised marketing decisions. However one thing that seems certain is that acquisition will probably continue to be an important way of establishing wholly owned operations abroad, throughout the new millennium.

BIBLIOGRAPHY

1. Anthony, J. F., “Establishing Successful Joint Ventures in Developing Nations: A CEO’s Perspective”, “Columbia Journal of World Business” 23 (Spring 1988): 65-71.

2. “Café au Lait, a Croissant- Trix”, “Business Week”, August 24, 1992, p50.

3. Chakravarty, M. , “Business Today”. Available from Internet

<URL: http://www.india-today.com

4. “Chrysler Committed to Production in Europe”, “Financial Times”, January7, 1997, p17.

5. “Cleaning Up Its Act to Fight the Giants”, “Financial Times”, September 27, 1994, p17.

6. Czinkota, M. R.; Ronkainen, I. A. and Moffett, M. H. (1996): “International Business” (4th Ed.): The Dryden Press : USA.

7. Dickens, P. (1992): “Global Shift”: Paul Chapman Publishing Limited.

8. “Digging a Mutual Trench”, “Financial Times”, March 11, 1991, p10

9. “French Drug Maker Reaps Profit with Offbeat Strategy”, “Wall Street Journal”, November 14, 1996, pB4.

10. Haspeslagh, P. C. and Jennison, D. B., “Acquisition Myth and Reality”, “Sloan Management Review” 10 (1987), 53-58.

11. Haspeslagh, P. C. and Jennison, D. B. (1991): “Managing Acquisitions: Creating value through corporate renewal” : The Free Press: New York.

12. “Jaguar to Enter Chinese Car Market”. “Financial Times”, October4, 1993, p.6.

13. Jeannet, J. P. and Hennessey, H. D. (1998): “Global Marketing Strategies” : Houghton Mifflin Company: USA.

14. Johnson, G. and Scholes, K. (1993): “Exploring Corporate Strategy” (3rd Ed.): Prentice Hall :Europe.

15. Lyles,M. “Parental Control of Joint Ventures: A Case Study of an International Joint Venture”, “Advances in Strategic Management” 7 (1991), 185-208.

16. ‘McDonald’s Conquers the World”, “Fortune”, October 17, 1994, p102.

17. Marwick, Peat., 1983, “Investment in Japan”, 5.

18. “Mergers: Will they ever learn?”, “Business Week”, 30 October 1995, p178.

19. Onkvisit, Sak and Shaw, John, J. (1993): “International Marketing- Analysis and Strategy” (2nd Ed.): Prentice Hall International.

20. Palinwoda, S. J. and Thomas, M. J . (1998): “International Marketing” (3rd ED.): Butterworth Heinemann.

21. Root, F. F. (1994): “Entry Strategies for International Markets”: Lexington Books..

22. Salter, M. and Weinhold, W. (1979): “Diversification through Acquisition”: Free Press: New York.

23. Singh, H. and Montgomery, C., “Corporate Acquisition Strategy and Economic Performance”, “Strategic Management Journal” 8 (1987), 377-386.

24. “Suddenly its time to buy America”, “Business Week”, 27 March 1995, p58.

25. Taggart, J.H. and McDermott, M.C. (1993): “The Essence of International Business” : Prentice Hall International.

26. Terpstra, V. and Sarathy, R. (1991):” International Marketing” : The Dryden Press.

27. Thakur, M.; Burton, G. E. and Srivastava, B.N. (1997); “International Management- Concepts and Cases” : Tata McGraw Hill: New Delhi

28. “The world is not always your oyster”, “Business Week”, 30 October 1995, p178.

29. “Upfront”, “Business Week”, 13 February, 1995, p8.

30. Weber, J., “Drug Merger Mania”, “Business Week” (May 16, 1994, p30-31).

31. Young, S. (1992): “International Business” :Bell and Basin Limited, Glasgow.

32. Zikmund, W. G.; Middlemist, R. D. and Middlemist, M. R. (1995): “Business- The American Challenge for Global Competitiveness”: Irwin.

33. <URL: http:// www.sbe.csuhayward.edu.html>

34. <URL: http:// www.ite.doc.gov.html>

35. <URL: http:// www.clarusresearch.com.html>

Appendix

Examples of Entry Strategy Alternatives:

Exporting: Direct [ E.g. Komatsu exporting earth-moving machines to the US.]

Indirect [E.g. “Jaguar appointed Inchcape, a UK based services and industrial marketing group as its importer/ distributor for China”. (Financial Times, 1993, p6 cited in Jeannet, J. P. and Hennessey, H. D., 1998, p309) ]

Licensing: [E.g. “Sanofi, a French pharmaceutical company appointed Bristol-Myers Squibb to market the drug, Plavix in the US.” (Wall Street Journal, 1996, pB4 cited in Jeannet, J. P. and Hennessey, H. D., 1998, p313) ]

Franchising : [E.g. “Of the 4,700 McDonalds’ restaurants in 1994 around 70% were franchised.” (Fortune, 1994, p102 cited in Jeannet, J. P. and Hennessey, H. D., 1998, p315) ]

Contract Manufacturing: [E.g. “Chrysler has a contract manufacturing agreement with Dailmer - Puch, an Austrian group, to build its Jeep Cherokee model at an yearly volume of 47,000.” (Financial Times, 1997, p17 cited in Jeannet, J. P. and Hennessey, H. D., 1998, p316) ]

Assembly: [E.g. Daewoo , the motor vehicle manufacturer of Korea has an assembly operation in Vietnam.]

Local Production: [E.g. “In 1982, Honda became the first Japanese car manufacturer to set up production in the US.” (Jeannet, J. P. and Hennessey, H. D., 1998, p317) ]

Joint Venture: [E.g. “The collaboration between Caterpillar of the US and Mitsubishi Heavy Industries of Japan” (Financial Times, 1991, p10 cited in Jeannet, J. P. and Hennessey, H. D., 1998, p323) ]

Strategic Alliances: [E.g. “General Mills of the US entered into a global alliance with Nestle of Switzerland to form Cereal Partners Worldwide, owned equally by both companies.” (Business Week, 1992, p50 cited in Jeannet, J. P. and Hennessey, H. D., 1998, p328) ]

Acquisitions: [E.g. “Reckitt and Coleman of the UK buying L&F Household from Eastman Kodak to compete with Procter and Gamble.” (Financial Times, 1994, p17 cited in Jeannet, J. P. and Hennessey, H. D., 1998, p329) ]

MBA Assignments Academic Homepage