financial management assignment

Explain and discuss the purposes and features of budgeting and budgetary control systems. How does the theory fit in with your experience of budgets in your own organisation?

acknowledgements

I would like to thank Mr. Amit Kapoor, my course leader for Financial Management for his continuing interest, encouragement, and support in helping me complete this assignment.

We are all influenced by the thoughts and ideas of other people which tend to drift into the subconscious and are not always distinguished clearly from one’s own. I have attempted to give references for sources of work by other writers but apologise to any concerned if acknowledgement has inadvertently not been recorded.

Contents

1. Acknowledgements

2. List of Figures

3. Abstract

4. Introduction

5. Features of Budgets and Budgetary Control

6. Budgetary Control

7. Types of Business Budgets for Managerial Control

8. Purposes of Budgets and Budgetary Control Systems

9. Budgetary Control at Fashion Fabrics

10.Role of Budgeting at Fashion Fabrics

11.Limitations of a Budgetary Control System

12.Conclusion

13.Bibliography

abstract

The business world today has become a very dicey game and the need for systematic and accurate information estimation if felt by every organisation. One way for managers to prepare detailed plans co-ordinating several activities is through the use of budgets and the development of an effective Budgetary Control System. A budget is a monetary plan prepared for a definite period and the term Budgetary Control connotes controlling on a budget. There are various types of budgets which are prepared for different time frames. A Budgetary Control System helps in planning, controlling, co-ordinating resource allocation, motivation, strategy formulation etc. and form an integral part of managerial decision making. In the second part of the assignment the Budgetary Control Systems at Fashion Fabrics, a textile trading organisation located in Sharjah have been analysed. The various stages in the budget preparation have been identified and the role of the Budgetary Control System has been studied. Finally some limitations of a Budgetary Control System have also been highlighted and its future role has been described.

Introduction

Modern businesses operate in a highly volatile and dynamic environment and the need for systematic information has become greater than ever. Management wants that all operation should be forecasted and as far as possible planned ahead and the actual results compared with the planned ones. Managerial decisions frequently have implications for a number of functions of a business. It is very important for managers to co-ordinate these interrelated aspects of decision making. One way for managers to co-ordinate their activities is to prepare detailed and explicit plans of action for specific future periods. These plans are referred to as Budgets and the co-ordinating activity is usually termed as Budgetary Control.

Features of Budgets and Budgetary Control

The Chartered Institute of Management Accountants, England, defines a budget as under:

“A financial plan and/or quantitative statement prepared and approved prior to a defined period of time, of the policy to be pursued during that period for the purpose of attaining a given objective.” (Jain, S.P. and Narang, K.L., 1995, p 5.156). An analysis of the definition given above reveals the following essentials of a budget :

· A budget is a monetary and/or quantitative statement of policy.

· The policy to be followed to attain the given objectives must be laid down before the budget is prepared.

· A budget is prepared for a definite future period which is defined well in advance. The period selected may be short or long range depending n various factors such as the life cycle of the firm’s products, the type of customers, the stability of demand for the firm’s products, the existence of any constraints on any operations and the characteristics of the industry.

In many organisations budget help frame an entire programme covering all operations of the enterprise. Many individual budgets are developed in different departments and subsequently integrated into one master budget. As the size of the organisation increases, the need for budget also becomes more.

Budgetary Control

“The Chartered Institute of Management Accountants, England defines Budgetary Control as - The establishment of the budgets relating to the requirements of a policy and the continuous comparison of actual with budgeted results either to secure by individual action the objectives of that policy or to provide a firm basis for its revision.” (Jain, S.P. and Narang, K.L., 1995, p 5.156).

Budgetary Control as a technique possesses certain special features which are as follows:

· It pre-supposes the existence of enterprise plans and sub-plans as well as the activities by various departments.

· It pre-supposes the co-ordination of various departmental plans and budgets for developing a master budget for the entire enterprise.

· Recording of the accomplishments at various intervals and its corresponding comparison with set standards.

· It determines variations and its causes after comparison.

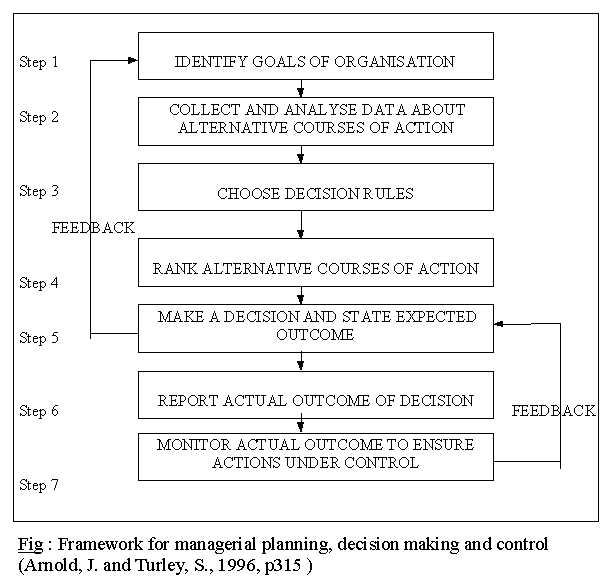

· Suggests and implements remedial and corrective measures. This is represented in the diagram below:

Types of Business Budgets for Managerial Control

Within the purview and framework of the master budget or the general budget of the firm, a number of sub-budgets for different business operations are prepared. Functional budgets may include the following:

· Sales Budget including Selling and Distribution Cost Budget

· Production Budget which consists of :

Raw Materials Budget

Labour Budget

Manufacturing Overhead Budget

· Personnel Budget

· Plant Utilisation Budget

· Administration Cost Budget

· Capital Expenditure Budget

· Research and Development Cost Budget

· Cost Budget

Such functional budgets are first developed for integrating them into a master budget. The nature of the budgets depend primarily on the nature of the activities of the enterprise and the purposes which the budgets are intended to serve. While some organisations follow the Incremental Budgeting approach, others follow the Zero Based Budget approach. Both these approaches have their advantages and disadvantages and therefore some organisations adopt the Priority Incremental Budget System, which represents an economical compromise between Zero Based Budgeting and the Incremental Budgeting approach. For the actual preparation of the budget “ a budget committee is usually formed, comprising a representative from all departments, chaired almost inevitably by the chief executive.” (Thompson, Tim, 1997, p 95).

Purposes of Budgets and Budgetary Control System

· Planning: The main purpose that a Budgetary Control System serves is that the management personnel are compelled to think of the coming years in precise numerical terms which correlates the plans with the activities of the enterprise. It is a bridge through which communication is established between the top management and the operatives who are to implement the policies. This further lays down the basis for effective delegation of authority without loss of control. It also ensures that managers plan for future operations, anticipate problems and make decisions based on reasoned judgements.

· Co-ordination: “Techniques of Budgetary Control, when properly applied, have proved to be a valuable device of securing co-ordination.” (Chaturvedi and Agarwal, 1990, p 295). By making comparisons of actual performance and budgeted performance, a budget gives direction to the business. Information about the proposed activities of the firm can be communicated to different managers in different locations, through budget procedures.

· The extent of different claims on resources from managers of different departments are clearly highlighted in a budget and existence of scarce or surplus resources may be revealed and may lead to the formulation of new and improved measures of using resources economically.

· Control: Budgetary Control makes control effective by continuous monitoring of the actual performance so as to report the variations from the budget to the management for corrective action. Budgetary system integrates key managerial function by linking top management’s planning function with the control function performed at all levels in the managerial hierarchy. “Budgets thus facilitate management by exception.” (Arnold, J. and Turley, S., 1996, p 314).

· Budgets as Authority: The very process of Budgeting gives information to management about the feasibility and appropriateness of particular actions. Moreover once a budget is adopted, there is automatic sanction for executing the work promptly and factors critical to success in meeting targets are easily identified.

· “The use of budgets as a method of performance evaluation also influences human behaviour.” (Drury, Colin, 1996, p 470). Research studies conducted by Stedry proves that given a budgeted level of performance, an individual employee’s own personal goal or ‘level of aspiration’ also increases and his performance becomes much better.

· If individuals actively participate in preparing the budget and if it is used as a tool to assist managers, it can act as a strong motivational device by providing a challenge. This also helps in evaluating the efficiency and judging the performance of executive personnel and departmental heads objectively rather than on personal opinion.

· “A budget may take the form of a consolidated statement of the resource position required to achieve a set of objectives or put into effect a strategy.” (Johnson, G. and Scholes, K., 1993, p 333). Budgetary Control serves as a very important tool when the management needs to decide about turnaround strategies. Various Budgetary Control Models can be examined, tested and adjusted to see the implications of different strategies, or about the progress that can be achieved with different projects. Capital Budgeting, Revenue Budgets and Financial Plans are typically used in resource planning for strategy formulation and implementation.

· Due to increasing globalisation, Budgetary Control serves an even greater purpose for multinational corporations. The Budgetary system mainly serves them the following four main purposes:

+ “allocation of funds among subsidiaries

+ planning and co-ordination of global productive capacity and supplies

+ evaluation of subsidiary performance, and

+ communication and information exchange among subsidiaries and corporate headquarters.” (Leksell Laurent, 1981 chapter 5 cited by Czinkota et. al, 1996, p 731).

· A Budgetary Control System also helps in “organisation structure adjustments which may become necessary due to changes in work load caused by changed external environment conditions”. (Ghosh, P.K. and Saxena, R. G., 1991, p 44).

Because of these important functions, budgeting is sometimes said to have a ‘sense making’ role in organisations. It gives a representation of how the organisation perceives its own activities. Terms such as ‘over budget’ and ‘under budget’ may suggest particular value judgements about the functioning of an organisation. Moreover “decisions about what is included in and what is omitted from the budget implicitly communicate information about organisational values and priorities.” (Arnold, J. and Turley, S., 1996, p 315).

However to function effectively, a Budgetary Control System should fit with the overall framework for managerial planning, decision making and control as shown in the diagram below:

Budgetary Control at Fashion Fabrics

Having analysed the various purposes that a Budgetary Control System serves it would be worthwhile to see how effectively these are achieved in a real organisation. Fashion Fabrics is a textile trading organisation based in Sharjah. The product line of the organisation includes different types of fabrics of varied brands. It procures its goods from the local wholesale market at credit periods ranging between 2 and 4 months, and sells on a similar policy. However cotton tetoron material, is both bought and sold in wholesale on hard cash basis, and is sold to dealers in other emirates through a chain of outdoor salesmen.

The preparation of the budget at Fashion Fabrics follows a ‘bottom up’ process. The outdoor sales personnel are asked to estimate sales in their respective areas and the regional sales manager estimates the total sales for their respective regions. These estimates of sales demand are made after considering seasonal and cyclical trends, market research, economic conditions, past sales volume, level of advertisements and other promotions etc. Separate sales budgets for the retail and wholesale division are prepared.

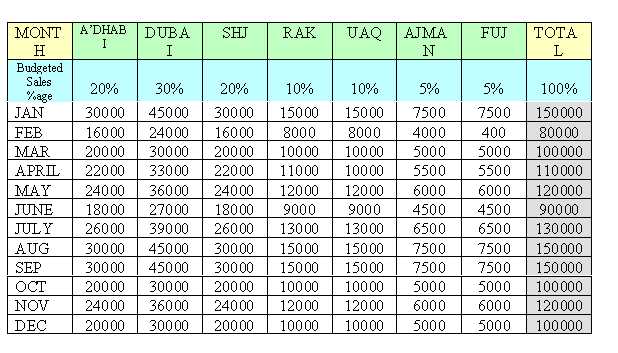

The Sales budget (wholesale division) of Fashion Fabrics for the year 1998:

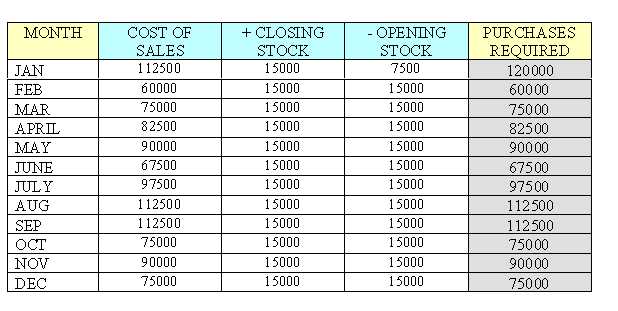

After formulating a Sales Budget a Purchases Budget is prepared, by the Purchase Manager, which shows the amount of goods to be bought for every month. Fashion Fabrics sells the cotton tetoron material @ AED 4 per metre and it is purchased @ AED 3 per metre. Fashion Fabrics used to maintain a closing stock of 2500 metres in the previous years, but has decided to increase this level to 5000 metres from the year 1998.

The purchases Budget is as shown below:

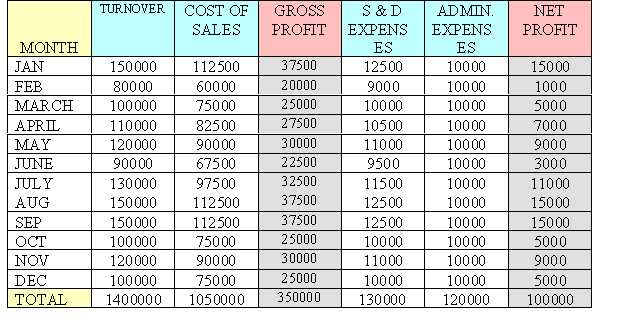

Alongwith the preparation of the Purchases Budget the company also prepares a Budgeted Profit and Loss account to know the trends in the monthly profit. It should be noted here that the company’s sales and distribution expenses include salaries, commission, car expenses, advertisement expenses, and other miscellaneous expenditure. A fixed expense of AED 5000 is incurred every month and the variable expenses are estimated at 5 % of the monthly sales. The administration expenses are fixed in nature and stand at AED 10,000 every month.

The Budgeted Profit and Loss Account is shown below:

Similar budgets are also prepared for the retail division where a variety of items are consolidated into a single sales budget. Finally other budgets such as the Cash Budget, Personnel Budget and Capital Expenditure Budget are also prepared and are incorporated into a final corporate budget known as the Master Budget.

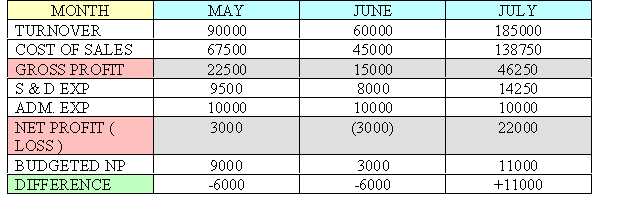

Once the preparation of the budget is complete, the correctness and accuracy of the budgeted estimates and the variances that occurred, if any, are identified in relation to the actual performance on a monthly basis. It is here where the actual work of the Budgetary Control System begins. Having identified any deviations, from the standard, which may be truly exceptional, the management at Fashion Fabrics considers adjusting budgeted levels to suit changed circumstances. The actual performance, for example, in the month of May was only AED 90,000, as against the budgeted level of AED 120,000. This fall in demand was due to international political situations especially in the subcontinent, and as Fashion Fabrics deals mainly in cotton tetoron produced in the subcontinent it led to the market expecting a downward trend in the prices. Considering the poor performance in May, the management revised the budgeted figure for June to AED 60,000. This adverse variance was offset when the pent-up demand led to increased sales to the tune of AED 55,000 in the month of July. However, inspite of the increased demand in July the net result was a fall in the profit by AED 1000.

This can be seen in the table given below:

Role of Budgeting at Fashion Fabrics

The Budgetary Control System has done much more than merely comparing financial figures with estimates. The bottom-up process of budget formulation has helped build an effective bridge of communication between the top management and the actual implementing staff. This lays down the basis formulation of ‘real’ plans and reasoned judgements and decision making has become possible. Through effective delegation of authority, the budgeting system at Fashion Fabrics also gives a direction to the business in general, and the budgetary objectives provide the employees a sense of united direction and action towards the attainment of business goals. Differences in actual performance highlighted through the Budgetary Control System has helped management divert its attention to optimum resource allocation and utilisation. Moreover giving a budgeted level of performance has also increased the sales personnel’s motivational levels. The regional sales budgets submitted by different regional managers has helped Fashion Fabrics evaluation of the organisation performance in different regions. The Budgetary Control System also guides the management in estimating the impact of key changes in their business policies such as pricing, terms of credit, advertisement expenditure etc. The departmental budgets are also compared to test the effectiveness of the managers in controlling the expenses for which they are responsible.

Limitations of a Budgetary Control System

A Budgetary Control System, no doubt serves as a multi-purpose tool, and helps management draw up the best course of action for the business. However it too suffers from certain limitations or disadvantages which are as follows:

· It is subject to human judgement and shortcomings.

· Budgetary Control neither ensures satisfactory results nor controls automatically. It merely identifies differences from budgets, and not the reasons for these differences.

· Determined standards become mandatory and are not always used.

· Budgeting involves a lot of forecasting which itself is full of uncertainties.

· The data to be effective has to be adequately interpreted and properly evaluated.

· Budgeting process usually being tied with the power structures of an organisation creates great difficulty in actually reallocating the resources to fit future recommended strategies.

· Budgetary Control requires much time, money and efforts for its successful use and to ‘keep it in line’.

Conclusion

Thus we can see that for effective managerial control, performance should not merely be checked but its should be measured against a budgeted level. The traditional model of budgets with clear objectives, cause and effect relationships identified and unambiguous actual performance measures exist only rarely in the real world. The process of Budgetary Planning and Control is an extremely complex one, bound up in the psychology of individuals with conflicting objectives arising between the use of budgets for different purposes. To serve its purposes effectively departmental budgets should be assembled and integrated in the form of a Master Budget, they should be flexible keeping in view the possibilities for alteration in the plans and the assumptions should be based on reliable information. The present day business environment is full of uncertainties on all fronts of the external environment. Only those organisations which continuously interpret the changed circumstances correctly and plan well in advance for them, through an effective Budgetary Control System, can hope to achieve continued success and growth well into the next millennium.

BIBLIOGRAPHY

1. Arnold, John and Turnley, Stuart (1996): “Accounting for Management Decisions” (3rd Ed.): Prentice Hall Europe.

2. Chaturvedi, C.L. and Agarwal, L.N. (1990): “Principles of Business Studies” (5th Ed.): Shri Mahavir Book Depot.

3. Czinkota, Michael, R., Ronkainen, Ilkka, A., Moffett, Michael, H. (1996): “International Business”: The Dryden Press.

4. Drury, Colin (1996); “Management and Cost Accounting” (4th Ed.): International Thomson Business Press.

5. Ghosh, P.K. and Saxena, R.G. (1991): “Business Studies” : NCERT.

6. Jain, S.P. and Narang, K.L. (1995): “Cost Accounting Principles and Practice” (13th Revised Ed.): Kalyani Publishers.

7. Johnson, Gerry and Scholes, Kevin (1993): “Exploring Corporate Strategy” (3rd Ed.): Prentice Hall.

8. Leksell, Laurent (1981): “Headquarters-Subsidiary Relationships in Multi-national Corporations” : Stockholm School of Economics.

9. Thompson, Tim (1997): “Financial Management-The Primer”: ULH Publications.

10. Watts, John (1996): “Accounting in the Business Environment” (2nd Ed.): Pitman Publishing.

MBA Assignments Academic Homepage