WELCOME

TO

ACCOUNTING

A hearty welcome and a big Hi to all of you.

Before we actually begin with the main subject matter I thought it would be better to introduce to you some relevant details about this subject. As you all know this subject is called Principles of Accounting - 1 (ACC 101) This course will give you an introduction to the various concepts and issues of business accounting. It will address various theoretical frameworks of accounting and will prepare you in the practical process of generating accounting information; leading to the preparation of financial statements.

The core text for this subject is Wood, Frank and Sangster, Alan (2002) "Business Accounting - 1", 9th Edition : Prentice Hall. Apart from the core text there are various other accounting books, journals and websites that you can effectively make use of to enhance your knowledge.

I shall also be providing you various handouts that will assist you in understanding and analyzing the subject.

The assessment of this paper is divided into four parts:

Attendance and participation 10 %

Assignment (10 x 4%) 40 %

Mid Term Exam (25 MCQs) 10 %

Final Exam (50 MCQs) 40 %

------

TOTAL 100 %

Further details about each of the above items will be provided to you as and when we approach them. However, do remember that a consistent performance is required throughout the course if you wish to achieve good grades. You must actively involve yourself in class discussions, presentations, home assignments etc. to get a thorough understanding of the subject and to support your answers with creative analysis, examples and insight. I hope now you have a clear view of the subject and it's effort requirements.

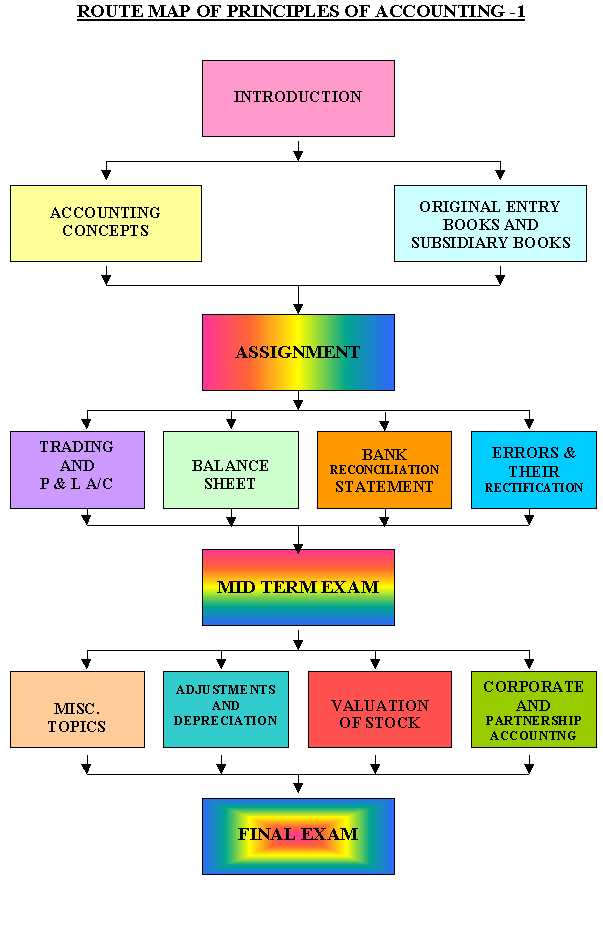

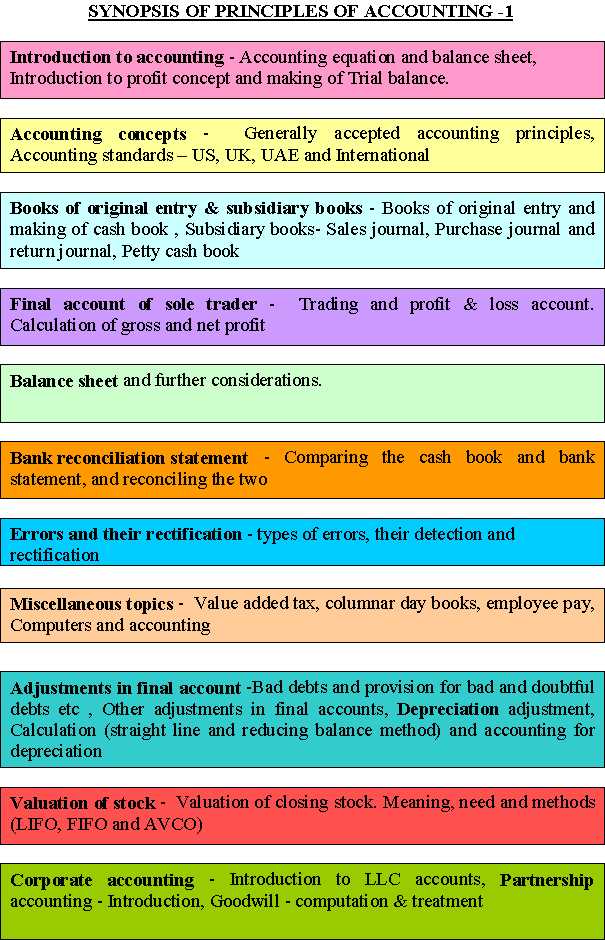

To give you a holistic picture of the various chapters in the subject, I have prepared a route map of ACC 101 and a synopsis of the course contents, which you can view at the end of this document.

If you need any assistance, regarding any aspect about the subject, please feel free to meet me at the college.

I expect you to put in sincere efforts towards this subject and at the same time I promise you that I will leave no stone unturned in making Principles of Accounting a most enjoyable and exciting experience for you all.

Take care and keep smiling :-)

Mr. Kishore Kumar

PRINCIPLES OF ACCOUNTING

Book Keeping - Process of recording accounting transactions in the various books of accounts

Accounting - process of recording, classifying, summarizing accounting data and then communicating what has been learned from it.

The Accounting Equation ASSETS = CAPITAL + LIABILITIES

In other words:

Assets = Capital + Liabilities

Capital = Assets - Liabilities

Liabilities = Assets - Capital

The Accounts for Double Entry

Accounts To Record Entry in Account

Asset Increase Debit

Decrease Credit

Capital Increase Credit

Decrease Debit

Liabilities Increase Credit

Decrease Debit

Accounting Concepts and Conventions

Accruals Concept: the concept that profit is the difference between revenue and expenses.

Business entity concept: assumption that only transactions that affect the firm, and not the owner's private transactions, will be recorded.

Consistency: keeping to the same method of recording transactions

Cost concept: assets are normally shown at cost price

Dual aspect concept: the concept of dealing with both aspects of a transaction

Going concern concept: assumption that a business is to continue for a long time

Materiality: recording something in a special way only if the amount is not a small one.

Money measurement concept: the concept that accounting is concerned only with facts measurable in money.

Objectivity: using a method that everyone can agree to

Prudence: ensuring that profit is not shown as being too high, or that assets are not shown at too high a value.

Realization concept: the concept of profit as being earned at a particular point

Separate determination concept: the amount of each asset or liability should be determined seperately

Subjectivity: using a method that other people may not agree to, derived from one's own personal preferences

Substance over form: where real substance takes precedence over legal form

Time interval concept: final accounts are prepared at regular intervals

Who uses accounting information ?

Owners - Shareholders, Partners

Bank

Government

Investors

Creditors etc.

Balance Sheet - a statement showing the assets, capital and liabilities of a business.

Creditor - a person to whom money is owed for goods or services.

Debtor - a person who owes money to a business for goods or services supplied to him.

Equity - another name for the capital of the owner.

Assets - resources owned by the business.

Liabilities - total of money owed for assets supplied to a business.

Account - part of double entry records, containing details of transactions for a specific item.

Trial Balance - list of account titles and their balances in the books, on a specific date, shown in debit and credit columns.

Double Entry Bookkeeping - a system where each transaction is entered twice, once on the debit side and once on the credit side.

Purchases - goods bought by the business for the purpose of selling them again.

Sales - goods sold by the business

Returns Inwards- goods returned to a business by it's customers.

Returns Outwards- goods returned by the business to it's suppliers.

Trading and Profit and Loss Account - combined account in which both gross profit and net profit are calculated.

Gross profit - found by deducting cost of goods sold from the figure of sales.

Net profit - gross profit less expenses

Financial Statements - trading and profit and loss account and balance sheet collectively

Cash book a cash book may be of three types:

Single column cash book: here the cash book contains only one column i.e. Cash column

Double column cash book: here the cash book contains two columns i.e. cash and bank

Three column cash book: here the cash book contains discount, cash and bank columns

Discount allowed: cash discounts allowed by a business to it's customers when they pay their accounts quickly.

Discount received: cash discount received by a business from it's suppliers when it pay it's dues quickly.

An entry which appears on both sides (debit and credit side) of the cash book is called a CONTRA entry. For example, cash from office deposited into bank OR cash withdrawn from bank for office use.

Day books Day books may be:

Purchases Day Book: to record all credit purchases

Sales Day Book: to record all credit sales

Purchase Returns Day Book: to record all purchase returns

Sales Returns Day Book: to record all sales returns

Trade discount: when some customers buy more quantity, we give them a discount which is known as Trade discount.

Petty Cash Book The main cashier may not be able to spend money on petty (small) expenses, so he appoints a petty cashier who would be given a weekly allotment of some amount (say 100 or 200) which is known as "Weekly Float" or "Petty Cash Float". The petty cashier spends from this amount and usually after a week's spending, he prepares a statement of expenditure and submits it to the main cashier who in turn records the total expenses as petty expenses. The main cashier then reimburses the amount spent by the petty cashier. This system is known as the "Imprest System of Petty Cash Book".

Home Page Academic Non-Academic